How to teach your kids about gambling

- Will Rainey

- Dec 8, 2020

- 6 min read

As I’ve written blogs about both investing and the stock market, I feel I should also raise the subject of gambling as there are some similarities but also some LARGE! differences. I want to help you, as parents, teach your kids the difference between gambling and investing and, very importantly, to help your kids learn that gambling is a BAD idea!

Our demand for instant gratification makes gambling more appealing than ever!

Before I get into how to talk to your kids about gambling, I want to first highlight my fear that gambling could become an even bigger problem than it is today. This is because we are moving into a world where everyone wants everything now! We want the things we order online to be delivered within 24 hours. We want instant access to all books, movies, music and games ever made. We want new fashion fast (this ‘we’ is probably more ’they’, the kids). We want our food to be delivered within 30 minutes. Everything has to be NOW!

With this demand for instant gratification, you can see the appeal of gambling.

“How can I get rich NOW? You could gamble and, if you win, you’ll have plenty of money for all the things you want NOW!”

This desire for instant gratification and the ease at which you can access gambling sites / apps makes for a potentially, extremely worrying future.

This is why parents need to spend time with their kids to help them learn about delaying their gratification and, to highlight the downsides of gambling. This blog is here to help!

How I defined investing versus gambling to my kids

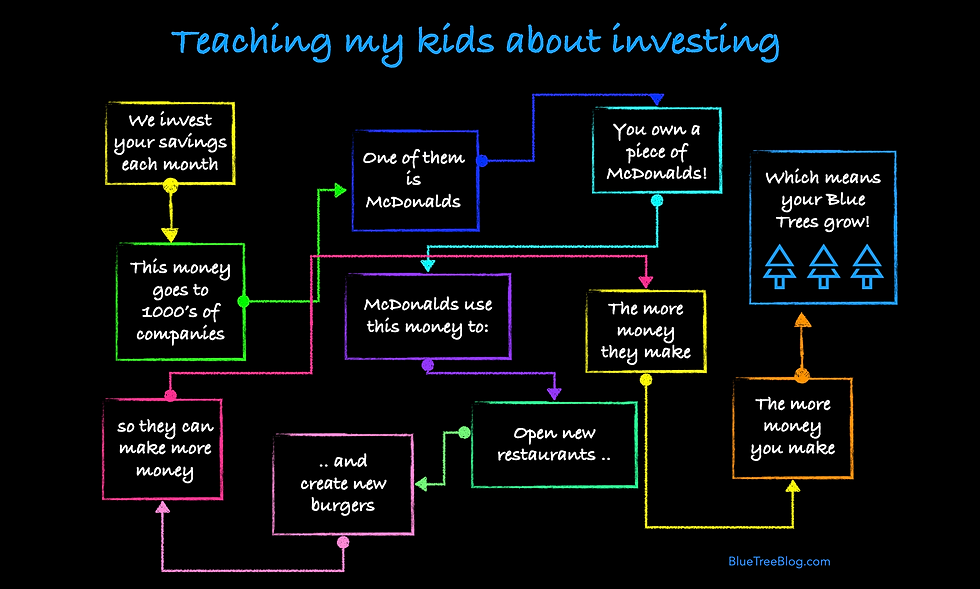

For those that have read my blogs before, you’ll know that we invest our kids' savings in the stock market and then show them these savings as Blue Trees. The more they save, the bigger their Blue Tree forest grows.

The analogy above clearly defines investing as something that grows over the long term. Granted, at some points in time the Blue Trees (investments) might not grow or might even get smaller, but the expectation is that over the long term they will recover and grow back stronger.

The key here is that you can’t use a ‘growing’ analogy with gambling. Gambling is much more of a mutation change. Rather than seeds that you grow, you can think of gambling like a caterpillar going into its cocoon. You hope that a beautiful butterfly will come out. However, in a lot of cases the caterpillar dies in the cocoon (either naturally or from being eaten by prey). There are no ‘half’ butterflies. There are no dead caterpillars that come alive again. It’s a beautiful butterfly - or nothing.

You can then explain to your kids the different forms of gambling such as horse race bets and casino games. The key is that the outcome is either good or bad. This is unlike investing where something might feel bad (i.e. the stock market falls) but, whereas in contrast it can recover over time.

If you want to teach your kids why companies in the stock market are expected to grow you can either read my blog on this topic (link) and / or use this graphic (which is using one company as an example only):

I appreciate that talking about dead caterpillars isn’t the most cheery of analogies but it is something that my kids understand. Also, the somber nature is a good backdrop for talking about gambling.

Gambling on the stock market

It’s important to note that I talk about ‘investing’ in the stock market. You can also ‘gamble’ on the stock market - which I strongly discourage.

This is important as some people feel that as they are putting money in the stock market they are investing - but actually they are gambling. The difference is all about the time horizon.

If you are putting money in the stock market with the aim of making money in the short term then you are gambling on the stock market. You are not allowing this money time to grow. You are hoping that you get a butterfly but no one knows what the stock market is going to do over the short term (despite a lot of people providing educated guesses).

Over my career, I have spoken with a lot of investment managers. Some have told me about the ‘investments’ they are making which are going to make them money over the short term as they have done a lot of research on their investments and believe they know something special.

In my life, I have also spoken to people who have bet on horses. Some have told me about the ‘bets’ they are making and how they are going to make them money over the short term as they have done a lot of research on the horses and believe they know something special.

To me, both of the above are the same. It might be that the research both have carried out means that they believe the chances of a good outcome are better than what most other people think, but it’s still gambling, as they are expecting a butterfly to suddenly appear.

If you are putting your kids’ money in the stock market, make sure you are taking a long term view and let that money grow rather than trying to take a lot of ‘bets’.

There are a number of resources out there that allow your kids to use pretend money to buy and sell companies on the stock market so they learn about investing. Please be aware of these resources. They could do more harm than good. This is very similar to teaching your kids to gamble with pretend money. Given that most professionals don’t make money from making short term bets on specific companies, it makes little sense getting your kids to believe they can.

Game to help your kids experience the difference between gambling and investing

Here is a game I played with my two daughters to help them learn the difference between investing and gambling.

We got two lots of 11 (lego) bricks each and a coin.

I said we’d flip the coin 11 times. They have the choice of either:

Getting one brick each time we flipped the coin regardless of the outcome (the saving / investing option)

Getting three bricks if they guessed the correct side of the coin, or losing two bricks if they guessed wrong (the gambling option)

The first one to get to 11 bricks wins.

They chose option 2 as it seemed like more fun and had the potential for bigger rewards (3 bricks versus 1). I took the other option.

We played twice and you guessed it - I won easily both times.

Their response: “It’s not fair Daddy!”

This is exactly what I wanted them to feel. This really drove home that gambling isn’t fair (or fun when you lose).

Notes:

If they do happen to win the first game then make sure you do best of 3 or 5 as the odds are materially in your favour.

I appreciate that you don’t get certain outcomes from investing in real life but I do believe that if you invest you will get a better outcome over the long-term (plus I wanted to keep the game simple)

Whilst part of this game is gambling (which isn’t the type of game I’d usually encourage kids to play), the key element is the comparison to a better alternative so they can learn.

Summary

Out of all the things that people now want instantly, money is going to be high on that list. One way to (potentially) achieve this is by gambling. This is why it is so important to talk to our kids about this topic from an early age.

We need our kids to appreciate that to make money, you need to be patient. There are no quick wins. If there were, everyone would be doing them and everyone would be rich.

Help them understand that they should think of their money like seeds which can grow over time and not like caterpillars which may or may not turn into butterflies.

Lastly, if you are investing in the stock market, teach your kids that the key is to take a long term view so they see their Blue Tree forest grow and avoid trying to pick which specific companies are going to do well in the short term. To help them see their Blue Tree forest grow then you can use the ‘Blue Tree Habit Maker'.

Thanks for reading!

Will

What to read next? The risks of investing